Which of the Following Issues Treasury Inflation Protected Securities

What are Treasury Inflation-Protected Securities. Treasury security whose principal value is indexed to the rate of inflation.

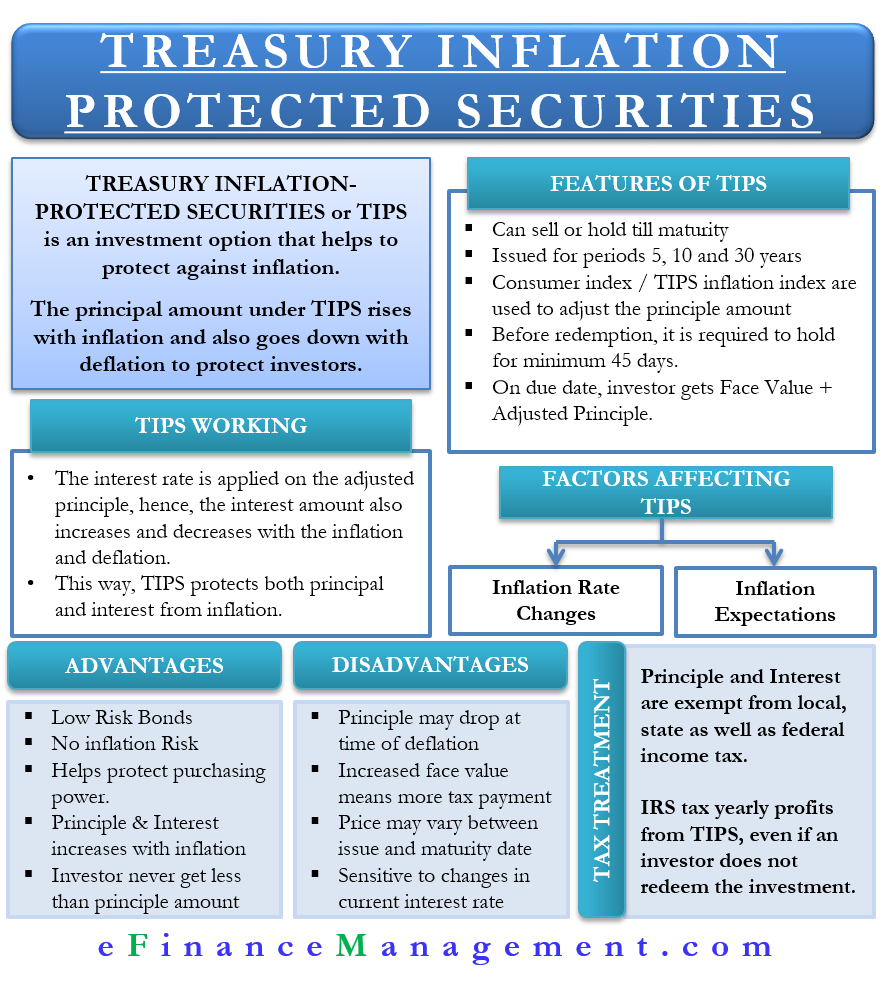

Treasury Inflation Protected Securities Tips Define Feature Pros Cons

US Treasury issues TIPS Treasury Inflation-Protected Securities.

. Based on the difference between the yields on a five-year Treasury bond FRED code. Evaluate the following statement. Which of the following issues treasury inflation.

Which of the following issues Treasury Inflation Protected Securities TIPS. Financial institutions and markets. Course Title FIN 370.

If theres deflation then the principal value is adjusted lower. Treasury Inflation-Protected Securities or TIPS are a type of US. The investor decides about what kind of securities to own such as bonds or stock.

Pages 26 This preview shows page 2 - 4 out of 26 pages. Treasury Inflation-Protected Securities TIPS are an often misunderstood fixed income asset class. Expert solutions for 11.

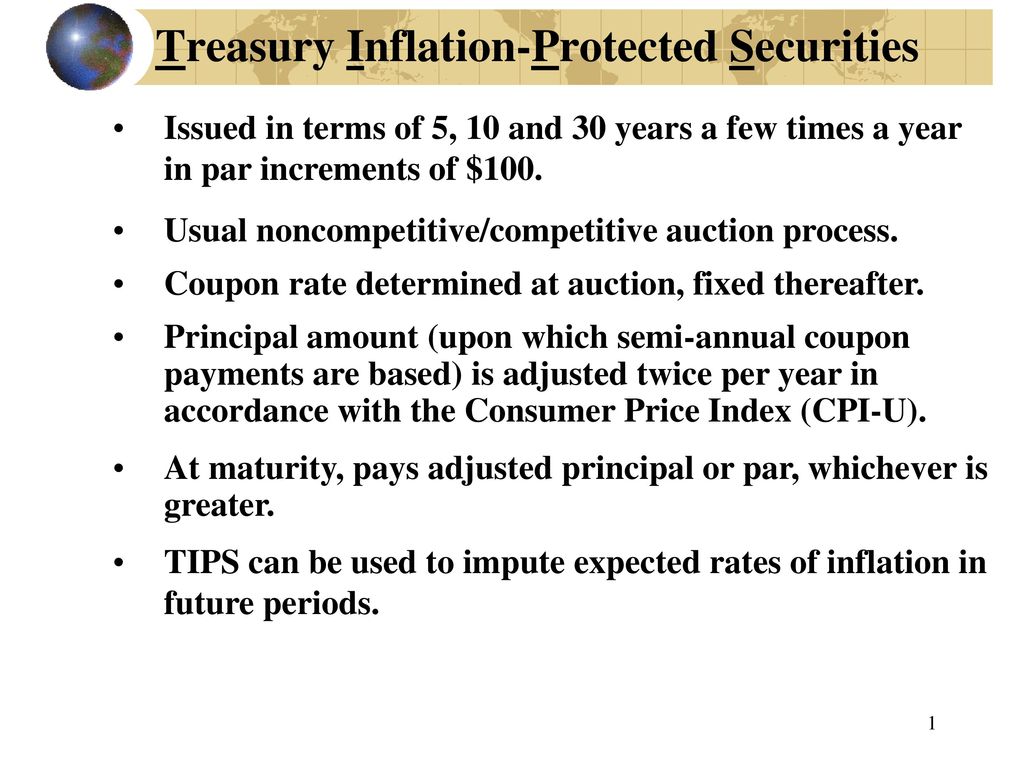

The Yield Curve for Treasury Nominal Coupon Issues TNC yield curve is derived from Treasury nominal notes and bonds. The returns on TIPS were especially strong across the longer maturities as were the returns on straight Treasurys. Pay a fixed interest rate for life.

Treasury Inflation Protected Securities TIPS Funds paid into a 401k or traditional IRA will. School University of Missouri. Surging Prices Put Treasury Inflation Protected Securities ETFs in the Limelight.

Learning more about the nuances mechanics and potential benefits of TIPS can help you. Treasury Inflation-Protected Securities TIPS A. Provide a constant stream of income in real inflation-adjusted dollars.

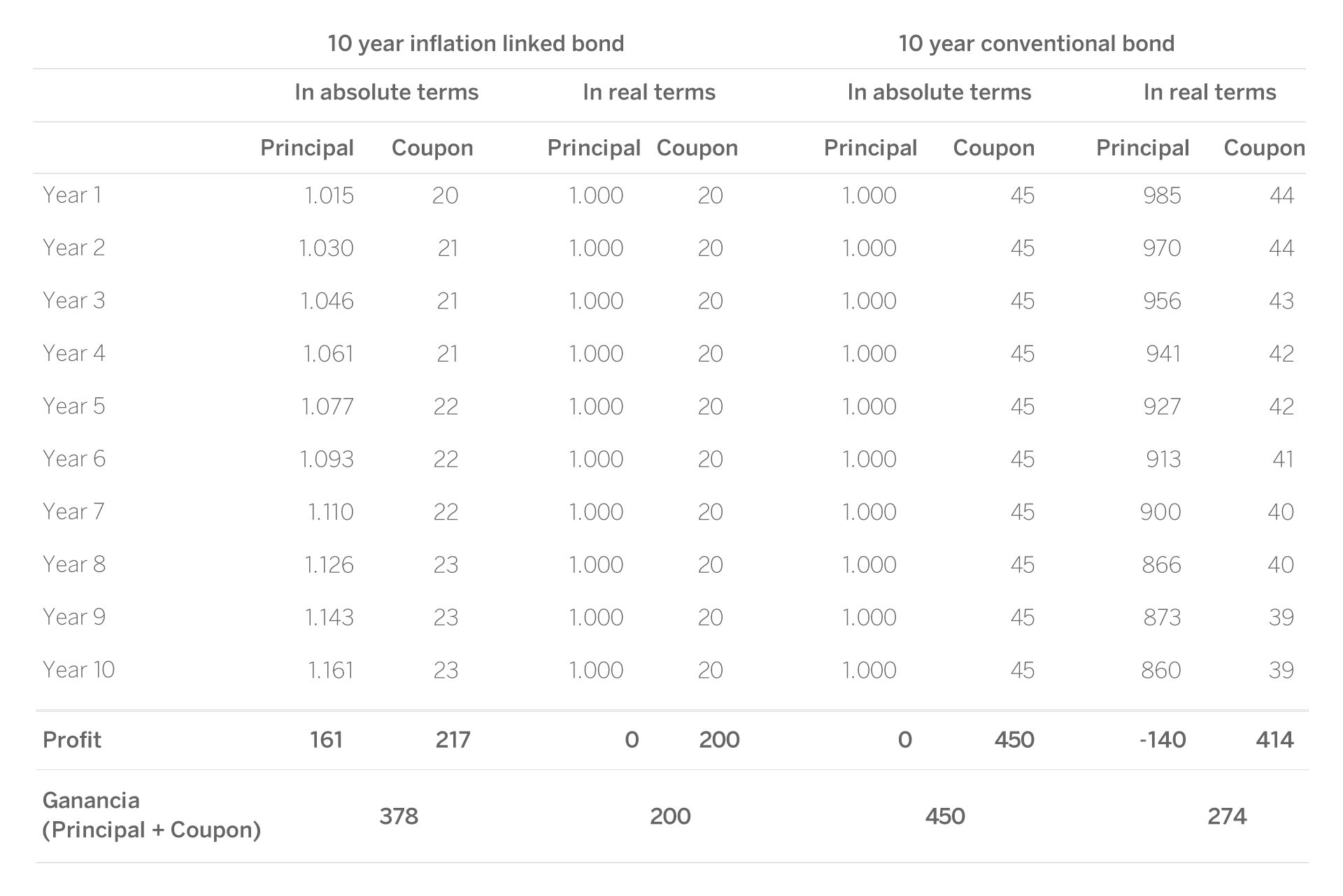

Treasury Which of the following is a debt security whose payments originate from other loans such as credit card debt auto loans and home equity loans. When a TIPS matures you are paid the adjusted principal or original principal whichever is greater. The basic notion behind their construction is to index the principal and income on a US.

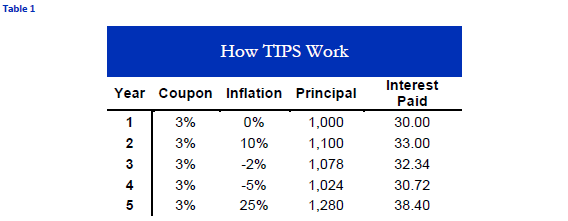

Pages 5 This preview shows page 3 -. When inflation rises the TIPS principal value is adjusted up. Pay a variable interest rate that is indexed to inflation but maintain a constant principal.

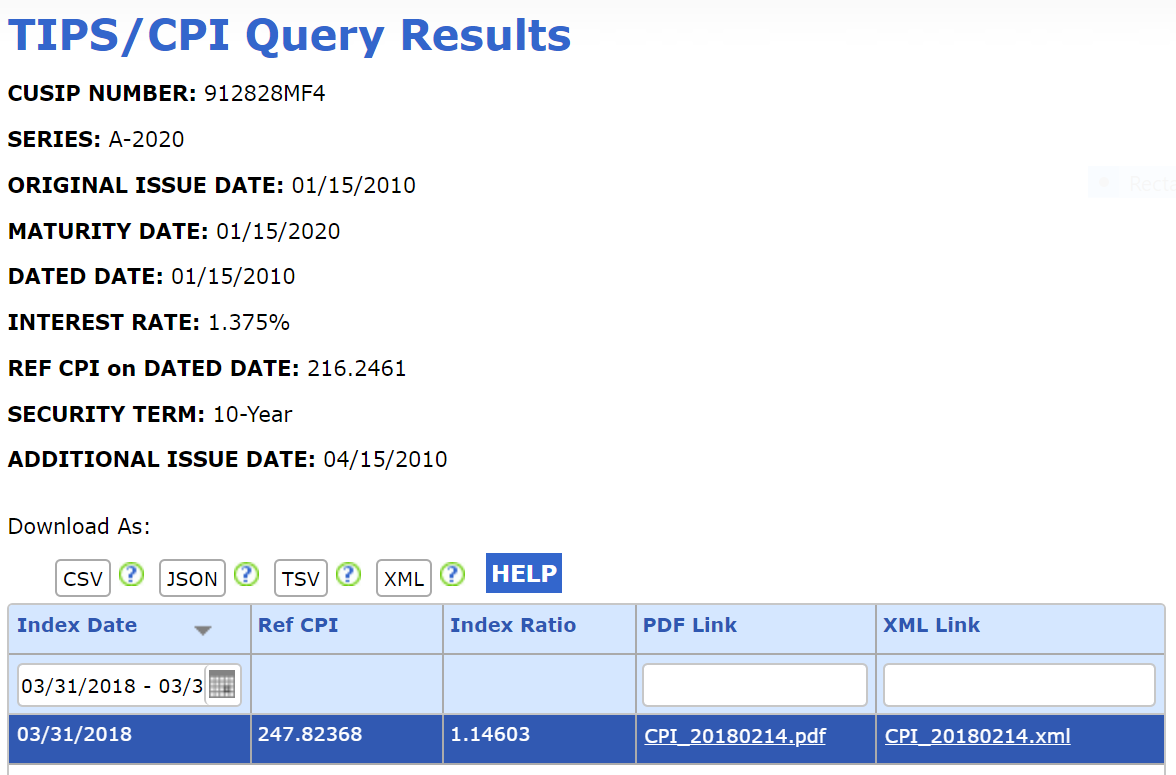

Treasury inflation protected securities TIPS pay a fixed coupon. Which of the following issues treasury inflation. GS5 and a five-year Treasury Inflation Protected Securities TIPS bond FRED code.

Which of the following issues Treasury Inflation Protected Securities TIPS. The Treasury inflation protected securities are also known as TIPS are defined as the treasury securities which gets adjusted in the price and get maintained in their real value when there is inflation or the price rise in the financial market and the securities which protect the investors from the decline in their purchasing power of the money against the negative impact of rising. United States Treasury inflation-protected securities TIPS are a simple and effective way to eliminate one of the most significant risks to fixed-income investments.

The principal of a TIPS increases with inflation and decreases with deflation as measured by the Consumer Price Index. The return on TIPS was driven by estimated price appreciation of 18 and a 13. Updated June 25 2019.

Which of the following are true about this security. With elevated consumer price pressures fixed income investors can hedge against rising. In reality however they are not.

Which of the following issues Treasury Inflation Protected Securities TIPS. Treasury Inflation-Protected Security TIPS is a Treasury bond that is indexed to an inflationary gauge to protect investors from the. These facilitate cash flows between investors and companies.

Treasury security to inflation1 The US TIPS market is the worlds largest inflation- indexed securities market with a market value of over 187 trillion2 The Federal. The Yield Curve for Treasury Real Coupon Issues TRC yield curve is derived from Treasury Inflation-Protected Securities TIPS. Banks and pension funds play major role in financial markets.

The Treasury Breakeven Inflation Curve TBI curve is derived from the TNC and TRC yield curves combined. It makes no periodic interest payments and makes one lump sum payment at maturity. Reduce your current tax liability but the retirement withdrawals from the account will be taxable.

Treasury Inflation-Adjusted Securities posted a 28 average return compared with a gain of 06 in comparable maturity straight Treasury securities in the 2021 fourth quarter. Pay a variable interest rate that is indexed to inflation but maintain a constant principal. Provide a constant stream of income in real.

Which of the following investments would provide the best protection against inflation. Course Title PHYSCS 2750. The IRS has issued final regulations on the tax treatment of Treasury Inflation-Protected Securities TIPS that have more than a de minimis amount of premium and temporary and proposed regulations on debt instruments with bond premium carryforward in the holders final accrual period TD.

Which of the following issues Treasury Inflation Protected Securities TIPS A. A relatively novel class of bonds Treasury Inflation-Protected Securities were introduced in the United States in 1997. Treasury Inflation-Protected Securities or TIPS provide protection against inflation.

Investors invest in bonds and stocks in financial markets floated by companies. Some investors hear inflation-protected and assume that TIPS returns are perfectly correlated to changes in inflation. The following questions are about Treasury.

January 8 2013. Max Chen February 8 2022. TIPS pay interest twice a year at a fixed rate.

Treasury Inflation Protected Securities Tips Bond Features And Yield

Treasury Inflation Protected Securities Tips Vs Traditional Sovereign Bonds

Tips On Tips Treasury Inflation Protected Securities Seeking Alpha

Treasury Inflation Protected Securities Tips What You Need To Know Walletgenius

Treasury Inflation Protected Securities Tips Bond Features And Yield

:max_bytes(150000):strip_icc()/dotdash_INV_final-Introduction-to-Inflation-Protected-Securities_Mar_2021-01-6c9fb72cb0d448d8ae2e68a37c58123c.jpg)

Introduction To Inflation Protected Securities

/dotdash_INV_final-Introduction-to-Inflation-Protected-Securities_Mar_2021-01-6c9fb72cb0d448d8ae2e68a37c58123c.jpg)

Introduction To Inflation Protected Securities

No comments for "Which of the Following Issues Treasury Inflation Protected Securities"

Post a Comment